10 Hypothetical Blockbuster AI M&A Deals

[ad_1]

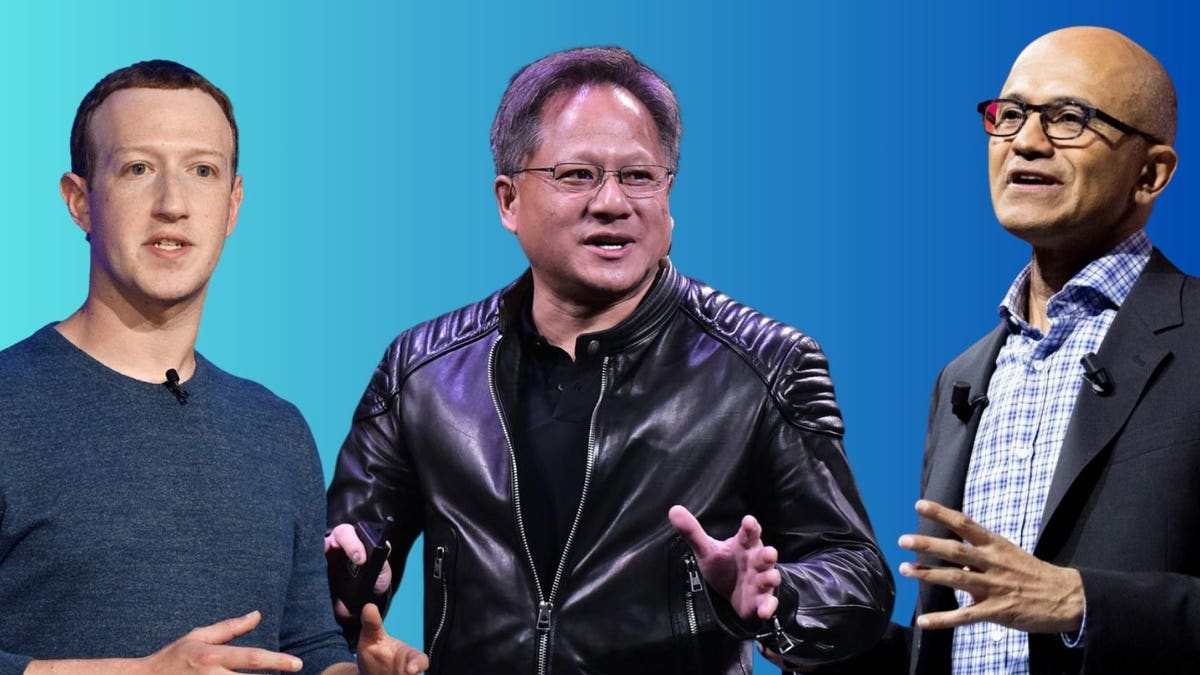

Meta CEO Mark Zuckerberg, Nvidia CEO Jensen Huang and Microsoft CEO Satya Nadella are among the … [+]

Getty Images

A wave of AI-related mergers and acquisitions are coming.

In C-suites and board rooms around the world today, one topic has taken center stage: What is our AI strategy?

Motivated by AI’s transformative potential—and terrified of being disrupted—many large companies will pursue strategic acquisitions in the months and years ahead as they seek to bolster their AI capabilities.

This trend is already underway, with Databricks acquiring MosaicML for $1.3 billion and Thomson Reuters acquiring Casetext for $650 million on the same day this summer.

Amid the AI fervor, let’s engage in a fun thought exercise: what splashy AI-related M&A deals might we read about in the headlines next?

To be clear, we are not suggesting that any one of these hypothetical deals is actually likely to happen. For one thing, antitrust headwinds loom large, with Lina Khan’s FTC eager to challenge any and all tech-related M&A.

But it is nonetheless instructive (and entertaining!) to reflect on which blockbuster acquisitions in the world of AI would be the most strategically compelling and make the most business sense.

These May Never Happen, But Here Are 10 Intriguing Hypothetical Deals

1. Microsoft Acquires Hugging Face

Hugging Face is often described as the “GitHub of AI.” It is an apt comparison. GitHub and Hugging Face are both open-source repositories where developers can share and explore one another’s work—code in the case of GitHub, AI models and datasets in the case of Hugging Face.

Microsoft’s $7.5 billion acquisition of GitHub in 2018 proved to be a savvy strategic move: the deal deepened Microsoft’s ties with the developer community, made it a leader in the open-source ecosystem, boosted its cloud computing business and provided numerous integration opportunities with existing business lines.

Five years later, a compelling logic exists for Microsoft to follow the same playbook and acquire Hugging Face, pairing it with GitHub to create the world’s leading open-source developer platform.

An interesting additional angle to this deal: while Microsoft is closely tied to OpenAI, fissures have begun to appear in the partnership in recent months and Microsoft is now seeking to lessen its dependence on OpenAI. Acquiring Hugging Face would help Microsoft position itself as a neutral platform on which a wide range of different AI providers and models, both closed-source and open-source, can thrive.

2. Meta Acquires Character.ai

Character.ai has created what may prove to be a game-changing new social experience for the era of generative AI. The app’s usage and growth numbers are eye-popping, particularly among the 18-to-24 age demographic.

Whenever it is faced with a new challenger in social media, Meta/Facebook does one of two things: it shamelessly copies the new entrant or it tries to acquire them (often both).

We have seen this movie play out numerous times over the past two decades. Meta/Facebook has famously copied product ideas from Twitter, Snapchat and TikTok, among others, over the years. It has also been willing to pay up to acquire rivals, including buying Instagram for $1 billion in 2012 and buying WhatsApp for $19 billion in 2014 (not to mention its unsuccessful attempt to buy Snapchat for $3 billion in 2013).

With Character.ai, Meta is already executing on the first part of this playbook, announcing a new chatbot concept last week that transparently mimics Character.ai’s product.

If Character.ai continues its meteoric rise in the months ahead, Meta would no doubt think seriously about buying the company outright in order to head off the competitive threat. (For the record, this hypothetical transaction is as unlikely as any on this list to actually come to fruition, given the antitrust cloud hanging over big tech in 2023.)

3. Snowflake Acquires Pinecone

When a major new technology platform emerges, the need—and opportunity—often arises to develop a fundamentally new type of database. This is because new technology platforms generally bring with them novel data modalities, data flows and data structures.

We saw this happen with the emergence of cloud computing a decade ago. Snowflake and Databricks were the big winners here, offering new database experiences purpose-built for the cloud era.

In the wake of AI’s rise, vector databases have burst onto the scene as the next buzzy new database architecture. Vector databases are specifically architected to handle vector embeddings, the elementary data structure on which today’s AI models are based.

While a number of vector database startups have emerged in recent months, none has seen more rapid adoption and revenue growth than Pinecone, whose valuation jumped from $30 million in 2021 to $750 million in 2023.

Now a $50 billion publicly traded company, Snowflake suddenly finds itself in the role of the established incumbent. It has an internal effort underway to build its own vector database offering, but don’t be surprised to see Snowflake make an acquisition here as it seeks to avoid losing a step in this fast-moving new category.

4. Nvidia Acquires CoreWeave

Nvidia’s most important customers—the large cloud providers Amazon Web Services, Microsoft Azure and Google Cloud Platform—are emerging as competitors. Amazon, Microsoft and Alphabet all are developing or have developed their own homegrown AI chips.

With the cloud providers seeking to move down the technology stack to the silicon layer to capture more value, what if Nvidia decided to move in the opposite direction, operating its own data centers and offering its own cloud services in order to reduce its traditional reliance on the cloud companies for distribution?

Nvidia has already begun exploring this possibility via a new cloud service called DGX Cloud. Acquiring CoreWeave, a specialized cloud provider focused on AI workloads, would represent a bold expansion of this strategy.

CoreWeave has experienced explosive recent growth thanks to the AI boom, with revenues jumping from $25 million last year to $500 million this year to a projected $2.3 billion in 2024. Nvidia and CoreWeave already have a close relationship: Nvidia is a major investor in CoreWeave and has helped fuel the company’s meteoric rise by giving it preferential access to Nvidia’s chips. Vertical integration could be the logical next step.

5. Intel Acquires Modular

Nvidia’s dominance in AI chips stems as much from its software as from its hardware. Nvidia’s CUDA platform is the most advanced software ecosystem in the world for parallel computing workloads—and it only works with Nvidia’s GPU chips.

Modular, a well-funded startup led by legendary Silicon Valley engineer Chris Lattner, aspires to be a “CUDA killer” by developing a reimagined suite of software infrastructure for AI that works across different hardware platforms and software frameworks.

One might expect Nvidia to be the obvious acquirer for Modular, in order to neutralize the threat that Modular poses to its lucrative CUDA ecosystem. But we think Intel represents an even more intriguing and compelling buyer. As they say, the enemy of my enemy is my friend.

Once the largest chipmaker in the world, Intel has been left in the dust by Nvidia as artificial intelligence has taken the world by storm. Intel has shown it is not shy about making big acquisitions as it scrambles to catch up in AI, for instance shelling out $2 billion for Habana Labs in 2019. Modular could represent Intel’s boldest AI bet yet, helping loosen Nvidia’s grip on the AI market by promoting a more open and flexible alternative to CUDA.

Moreover, Modular’s platform is built not just for GPUs but also for CPUs, which are Intel’s bread and butter.

6. Adobe Acquires Runway

Adobe is the world’s leading provider of software tools for the creative and design sectors. Runway is seeking to reinvent this category with a next-generation, AI-first platform for creative work.

Adobe has been impressively agile in reacting to the generative AI wave, developing its own proprietary generative model named Firefly and incorporating it into products like Adobe Photoshop and Adobe Illustrator. Firefly has been well-received; customers have used it to generate over 2 billion images in the past seven months.

Given Firefly’s success, Adobe need not make a kneejerk acquisition of a text-to-image or text-to-video startup like Midjourney, Ideogram or Pika Labs.

But Runway is more than just a generative model provider. The company aspires to create entirely new workflows for creative workers, offering a broad suite of AI-powered tools for visual design. Unlike the startups listed in the previous paragraph, which primarily serve consumers, Runway is finding adoption among creative professionals, enterprises and even Hollywood studios.

All this may convince Adobe that Runway is an asset worth owning.

7. Amazon Acquires Anthropic

This is the obvious and obligatory deal to include on this list, given last week’s news that Amazon is investing up to $4 billion in Anthropic. This investment could represent the first step to a full acquisition.

The deal rationale: Anthropic would be to Amazon what OpenAI is to Microsoft. An OpenAI spinout, Anthropic is one of the world’s leading AI research groups. Just as Microsoft has done with OpenAI, Amazon could incorporate Anthropic’s cutting-edge large language models (LLMs) across its sprawling business empire, from e-commerce to cloud services to logistics and beyond, unlocking billions of dollars of value.

8. Eli Lilly Acquires Inceptive

Artificial intelligence is poised to profoundly transform the field of biology in the years ahead. Few applications of AI will have greater impact on human civilization.

A handful of startups is at the vanguard of this revolution, applying the latest in LLM and generative AI technology to deepen our understanding of how living systems work and to design new medicines that will improve human health.

One of the most intriguing startups in this category is Inceptive. Fresh off a $100 million funding round from Andreessen Horowitz and Nvidia, Inceptive is applying cutting-edge AI to develop novel RNA-based therapeutics. Led by AI luminary Jakob Uszkoreit, the co-inventor of the transformer architecture that sparked today’s AI boom, Inceptive is chock-full of world-class computational and life sciences talent.

The big pharma companies have been closely monitoring the impact of AI on drug development for some time. To this point, they have mostly chosen to enter into partnerships with computational biology startups (e.g., Roche with Recursion, Bayer with Exscientia, Bristol Myers Squibb with insitro) rather than to acquire them outright. With AI’s capabilities improving at breathtaking speed and with AI hype crescendoing, one of the pharma giants may decide to take the plunge and buy a startup like Inceptive in order to bring its talent and technology platform in-house.

Which big pharma player is most likely to make a move?

Eli Lilly is a strong candidate, for a few reasons: it is deeply committed to RNA as a new therapeutic modality; it has made several smart bets in AI in recent years; and as the largest pharma company in the world, it is well-positioned to make a big acquisition.

9. Salesforce Acquires Gong

Few companies have been more exuberant about AI in recent months than Salesforce. The company recently launched a $500 million corporate venture fund dedicated specifically to generative AI. Salesforce chief Marc Benioff routinely makes high-flung proclamations about AI’s importance.

And Salesforce has a history of big-ticket M&A, from Slack to Tableau to Mulesoft.

Gong, which captures and analyzes sales conversations using machine learning, already integrates tightly with Salesforce’s CRM platform. The complementarities and synergies between the two products are clear.

Gong is a larger and more mature business than the other hypothetical acquirees mentioned in this article. Given it was most recently valued at $7.25 billion, Gong would be a big acquisition target to pursue, although with a market capitalization of $200 billion Salesforce would be equipped to absorb it.

In truth, Gong’s product stack is built using previous-generation AI and its $7+ billion valuation came at the peak of the frothy, zero-interest-rate market of 2021. The company might find itself receptive to an acquisition offer that allowed it to cash out and avoid having to navigate slowing revenue growth or a down round as an independent company.

10. Apple Acquires Inflection AI

Unlike its fellow tech giants Alphabet, Meta, Microsoft (via OpenAI) and now Amazon (via Anthropic), Apple lacks a deep bench of top-tier LLM talent.

Led by DeepMind cofounder Mustafa Suleyman, eighteen-month-old startup Inflection AI boasts a concentration of AI research talent that few organizations in the world can match.

Inflection’s main product, a chatbot named Pi, would represent a compelling and more sophisticated replacement for Apple’s Siri, which inexplicably missed the boat on LLMs and has quickly become outdated. Inflection’s clean, elegant aesthetic even seems well-matched to Apple’s iconic brand.

From Inflection’s perspective, the young startup’s appetite for computing resources is bottomless. The company raised a staggering $1.3 billion this summer in order to build the world’s largest GPU cluster. Joining forces with Apple—the largest and most cash-rich company in the world, with over $165 billion cash on hand—would enable Inflection to access all the compute it could ever dream of in order to build its next-generation models.

[ad_2]

Source link