50 Million Addresses Signal 20% Rise In Adoption

[ad_1]

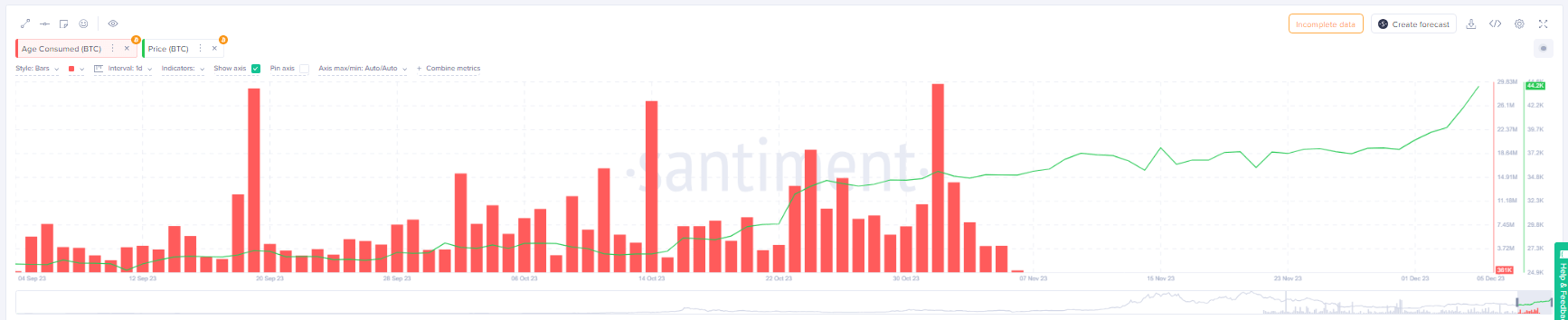

On December 4th, Bitcoin (BTC) witnessed an unexpected surge in its age-consumed metric, indicating a significant increase in previously inactive coins entering circulation.

This remarkable development, marked by a 400% surge in a 24-hour period, could potentially signal upcoming price volatility in the Bitcoin market.

The age-consumed metric in cryptocurrency serves as a key indicator that tracks the movement of tokens, particularly focusing on the time since these tokens were last transferred. This metric is calculated by multiplying the quantity of tokens that change addresses on a specific date by the duration they have remained stationary in those addresses.

Deciphering Markets: Long-Term Holder Insights Via Age-Consumed Metric

Essentially, it offers insights into the behavior of long-term holders by revealing shifts in token circulation. A notable increase in the age-consumed metric signals that a significant number of dormant tokens, held for an extended period, are now on the move, indicating a substantial and sudden change in the activity of long-term holders.

Bitcoin Age-Consumed Metric. Source: Santiment

Bitcoin Age-Consumed Metric. Source: Santiment

Conversely, a decrease in the metric suggests a period of stability, with long-held coins remaining in wallet addresses without being actively traded.

Traders and analysts closely monitor the age-consumed metric to glean information about potential market tops and bottoms. The metric’s fluctuations provide valuable data on the dynamics of token circulation and the behavior of long-term holders, contributing to a deeper understanding of market conditions.

BTC currently trading in the $43K territory. Chart: TradingView.com

Overall, the age-consumed metric is a tool that aids in deciphering the activity levels and potential shifts in sentiment within the cryptocurrency market.

As the king crypto achieves a significant milestone, surpassing $44,000 in price early Wednesday, the surge in the age-consumed metric becomes even more intriguing.

BTC breaches the key $44,000 barrier today. Source: Coingecko

Bitcoin Surges: Weekly Gain Signals Investor Confidence, Expanded User Base

This surge aligns with the cryptocurrency’s notable 16% gain in value over the past week, driven by increased demand and growing investor confidence. Data from Coingecko underscores this positive momentum, highlighting the expanding appeal of Bitcoin in the market.

Importantly, the cumulative number of BTC addresses has seen a 20% increase since the beginning of the year, aligning with the overall growth in the cryptocurrency market’s capitalization.

Total amount of Bitcoin holders. Source: Santiment

Total amount of Bitcoin holders. Source: Santiment

Insights from Santiment reveal that a robust count of 50 million BTC addresses currently maintains a balance, underscoring the cryptocurrency’s expanding reach.

The figure emphasizes the widespread participation in the Bitcoin ecosystem. The observation underscores the growing influence and adoption of Bitcoin as a digital asset, suggesting that an increasing number of individuals or entities are actively involved in holding and transacting with Bitcoin.

The recent surge in Bitcoin’s age-consumed metric adds an element of anticipation to its trajectory, hinting at potential market shifts and fluctuations in value on the horizon.

As the cryptocurrency landscape evolves, the influence of long-term holders and the dynamic interplay of market forces continue to shape Bitcoin’s journey beyond the $43,000 milestone.

Featured image from Freepik

[ad_2]

Source link