A Third Of Supply Unsold Since 5+ Years

[ad_1]

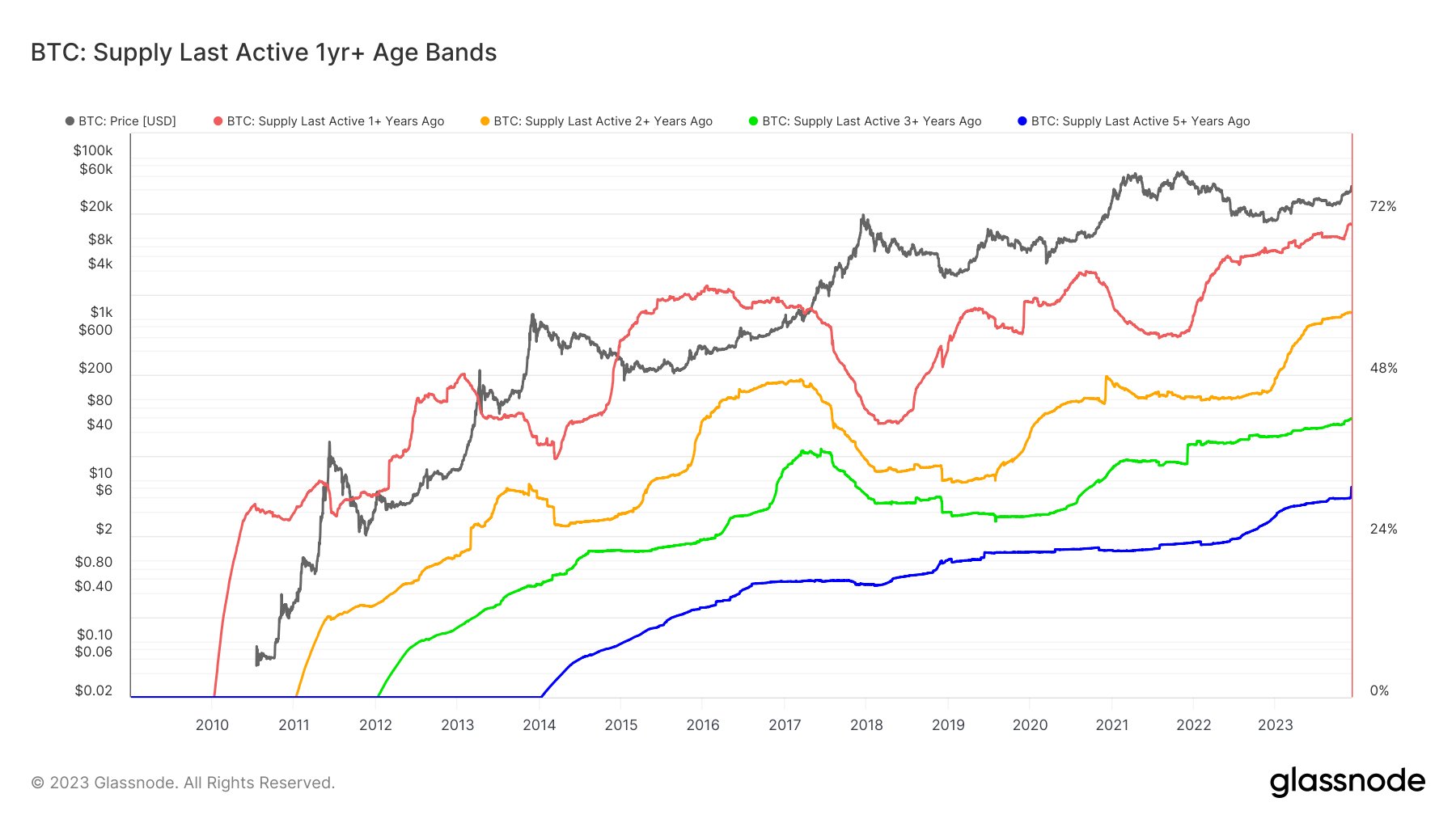

On-chain data shows about a third of the total circulating Bitcoin supply hasn’t seen any movement on the blockchain since over five years ago.

Bitcoin Supply Grows More Dormant As HODLing Continues

In a new post on X, analyst James V. Straten shared a chart showing how the Bitcoin supply held by the different long-term holder segments has changed over the asset’s history.

The “long-term holders” (LTHs) refer to those investors who have been holding onto their coins since at least 155 days ago. The holders who own coins with an age less than this threshold are known as the “short-term holders” (STHs).

Statistically, the longer a holder keeps their coins dormant, the less likely they become to move them at any point. Due to this reason, the LTHs are the more resolute group of the two, rarely selling their Bitcoin and staying strong even in times of significant losses or profits.

Now, here is a chart that shows the trend in the supply carried by specific bands of the LTHs, starting from the 1+ year segment:

Looks like all of these metrics have registered a rise in recent days | Source: @jimmyvs24 on X

As mentioned before, coins only become more likely to remain unsold the longer they stay dormant. These segments are a part of the Bitcoin LTHs, who are already quite resolute, but as one goes down these bands, this conviction becomes even stronger.

From the above graph, it’s visible that the BTC LTH supply that hasn’t registered any movement since 1+ years ago has observed a sharp increase recently. Something to keep in mind is that when this metric’s value goes up, it doesn’t mean that buying is taking place in the present.

Rather, the buying happened around a year ago; these HODLers have just kept their coins dormant long enough that they have now matured into this LTH age band. One year ago, BTC was still trading around its lows following the FTX collapse, so the latest increase would have come from the bottom buyers.

Interestingly, none of the Bitcoin LTH age bands have participated in any net selling recently, despite the fact that Bitcoin has observed some sharp bullish momentum. In fact, all of these groups have observed some degree of rise, implying that the HODLing behavior has only grown stronger.

Besides the 1+ years old band, the 5+ years old band has seen the most significant increase recently, as the supply held by these investors has now neared the 33% mark, suggesting that almost one-third of the asset’s supply has remained dormant for at least half-a-decade now.

As Straten has pointed out, five years ago was around when the bear market of the previous cycle saw its bottom. It would appear that some of the holders who bought them are still continuing to HODL the asset.

Considering the rollercoaster these Bitcoin investors would have experienced over the years and the massive profits they would be carrying by now, they would certainly have to be the diamond hands among the diamond hands indeed.

BTC Price

Bitcoin has seen its bullish momentum stall down in the last few days as the cryptocurrency is still trading around the $43,600 mark.

The price of the asset appears to have been moving sideways recently | Source: BTCUSD on TradingView

Featured image from Bastian Riccardi on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link