Bitcoin Demand Shock Nears As Institutions Accumulate Heavily

[ad_1]

Stablecoin issuer Tether and several US spot Bitcoin ETFs (exchange-traded funds) have made significant Bitcoin (BTC) acquisitions. Indeed, the developments signal a potential demand shock.

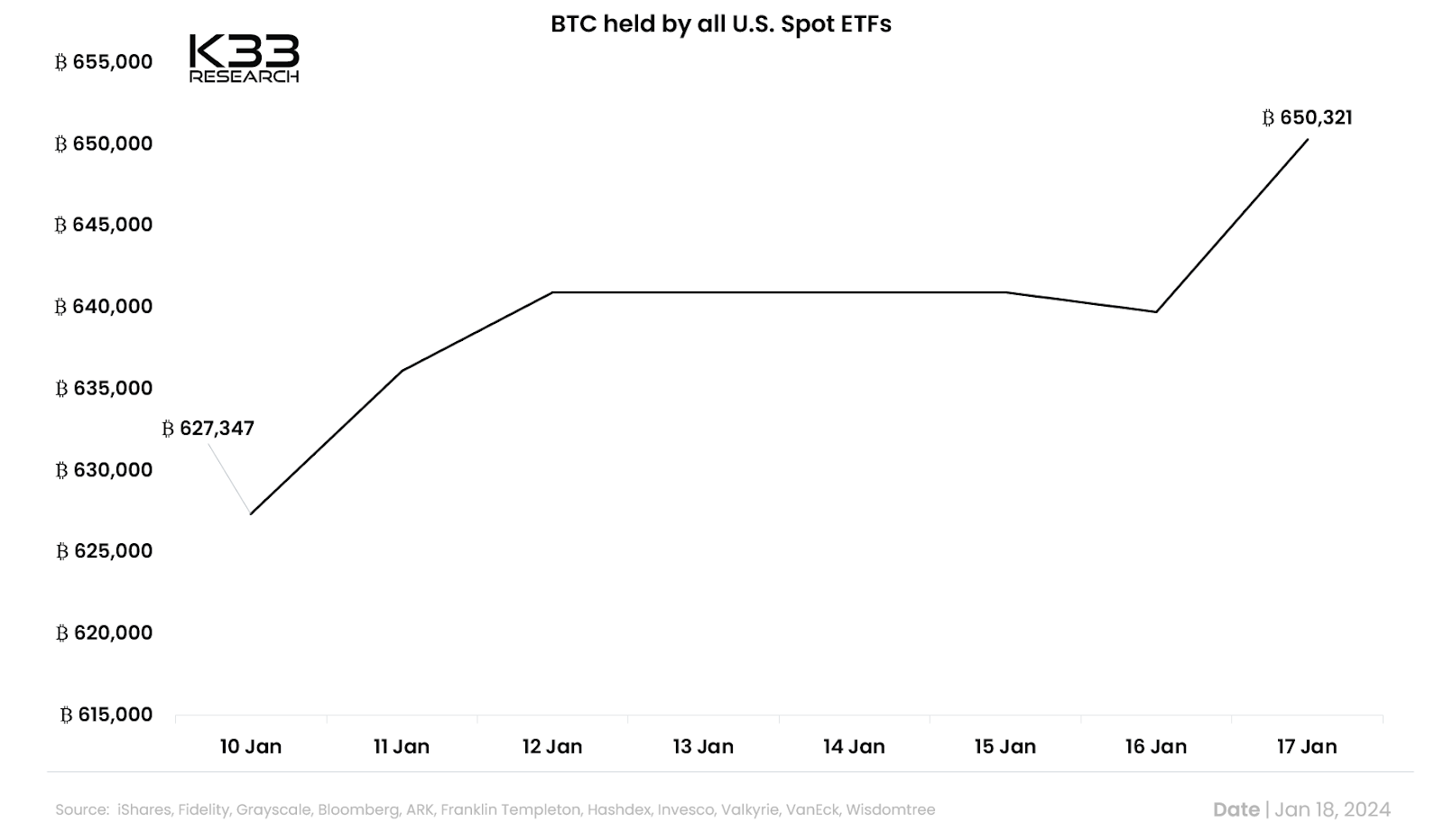

Tether recently added 8,888 BTC to its reserves. Now, its total holdings stand at a staggering 66,465 BTC, valued at approximately $2.8 billion. Meanwhile, spot Bitcoin ETFs have reached a landmark by collectively holding 650,000 BTC.

Potential Bitcoin Demand Shock

Tether’s latest acquisition, marking its third-largest to date, is part of a strategic initiative that began in September 2022. Since then, the company has consistently increased its Bitcoin holdings each quarter.

This strategy aligns with Tether’s shift in its reserve allocations, moving from traditional US government debt to crypto assets. Tether CEO Paolo Ardoino, affirming this strategy, stated that the company aims to allocate up to 15% of its quarterly profits to Bitcoin.

“The decision to invest in Bitcoin, the world’s first and largest cryptocurrency, is underpinned by its strength and potential as an investment asset. Bitcoin has continually proven its resilience and has emerged as a long-term store of value with substantial growth potential. Its limited supply, decentralized nature and widespread adoption have positioned Bitcoin as a favored choice among institutional and retail investors alike,” Ardoino said.

The significance of Tether’s increasing Bitcoin holdings is mirrored by the growing investment in BTC by spot Bitcoin ETFs. Thus far, since launch day, these ETFs collectively hold 650,000 BTC, indicating the growing institutional interest in Bitcoin.

According to a Senior Researcher at K33 Research, Vetle Lunde, the ETFs saw a record net inflow of 10,570 BTC in a single day. Undoubtedly, this highlights the escalating demand for Bitcoin among institutional investors.

“In terms of global flows, yesterday saw the strongest daily inflows YTD. The US single-handedly carries this growth as European and Canadian ETPs still face outflows,” Lunde added.

Read more: Who Owns the Most Bitcoin in 2024?

This parallel increase in Bitcoin holdings by Tether and Spot Bitcoin ETFs highlights a potential catalyst for a demand shock in the Bitcoin market.

With substantial quantities of Bitcoin being accumulated by these major financial players, the availability of Bitcoin on open markets could diminish, potentially impacting its price and liquidity. This is a scenario that even MicroStrategy CEO Michael Saylor expects.

“Mainstream institutions have not had a high bandwidth compliant channel to invest in this asset class until the spot ETFs. I think the approval of the spot [Bitcoin] ETFs is going to be a major catalyst that’s going to definitely drive a demand shock… It’s a pretty big deal,” Saylor said.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

The actions of Tether and the spot Bitcoin ETFs underscore the rising acceptance of cryptocurrencies in mainstream finance and may herald a new phase in the evolution of Bitcoin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link