Bitcoin’s Bullish Future: Why BTC’s Long-term View Still Looks Promising

After Bitcoin‘s recent price recovery from a major downswing last week triggered by a broader market decline, investors and traders have been speculating on the crypto asset’s performance in the short and long term. However, cryptocurrency analyst and trader, Mags, delving into the current price rebound has disclosed that BTC’s price in the long term still looks promising, demonstrating his confidence in the coin’s potential for further gains.

Long-Term Outlook For Bitcoin Still Holds Strong

The crypto analyst Mags, offered his perspective on the crypto asset’s prospect to the community on the X (formerly Twitter) platform, which is considered a major discussion among investors in the ongoing bull cycle.

Mags’ insights come at a time of recent market fluctuations, triggering fear and uncertainty around Bitcoin and other major cryptocurrencies. Despite these troubling market fluctuations, Mags continues to have a positive view of the future of the largest crypto asset.

While investors are concerned about the short-term volatility of BTC, raising the notion that Bitcoin is having difficulties when viewed over shorter time periods, the analysts highlighted that the long-term outlook for the flagship coin remains optimistic, bolstering the possibility of steady price expansion.

According to the crypto expert, the price of Bitcoin has not closed below the $60,000 support level on the monthly chart. Meanwhile, whenever the price drops below the $60,000 level, it immediately rises back above the mark.

The post read:

Many people might say that Bitcoin is struggling when looking at lower time frames. However, the long-term view still looks promising. On the monthly chart, the price hasn’t closed below the $60,000 support level. Every time the price dips below $60,000, it quickly pumps back above it.

In general, Mags noted that while the price has been moving around the $60,000 level, it continues to stabilize above its all-time high. He further highlighted that if the Lower Time Frame (LTF) falls below the support level, they could be traps before the price begins to move on the upward trajectory again. As a result, he has urged crypto investors not to be shaken by the recent price fluctuations and hold on for an imminent rally in the upcoming months.

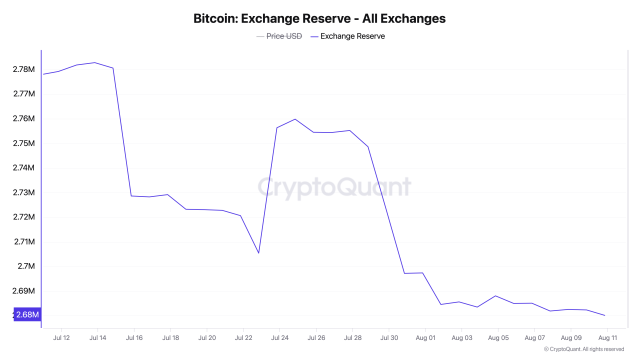

Centralized Exchange Reserves For BTC Falls Drastically

As Bitcoin continues to struggle in the midst of a general market decline, the overall amount of BTC held in centralized exchanges has witnessed a major drop.

According to CryptoQuant, a leading on-chain data provider, the total number of BTC held in centralized exchanges in the period of one month now boasts 2.68 million BTC, valued at a whopping $161 billion, marking its lowest level in the past 5 years.

This drop may be a sign of a longer-term bull market as more investors are choosing to hold their Bitcoin in cold storage or other types of self-custody storage, rather than centralized exchanges. It also underscores investors’ desire for the security that these cold storages present, which allows them to gain greater control of their funds.

Featured image from Adobe Stock, chart from Tradingview.com