Crypto Will Outperform Tech Stocks, Says Raoul Pal

[ad_1]

Prominent investor Raoul Pal has substantiated, using crucial data, that 2024 is poised to be a favorable year for crypto, surpassing the prospects for tech stocks.

“This is where the growth assets of NDX and Crypto live. This is why they bottomed before everything else,” the statement declared.

Pal Predicts Crypto Will Outperform Tech Stocks

In a series of posts on X (formerly Twitter), Pal a key market indicator and articulates his belief in a potential positive upswing in the crypto market over the next twelve months.

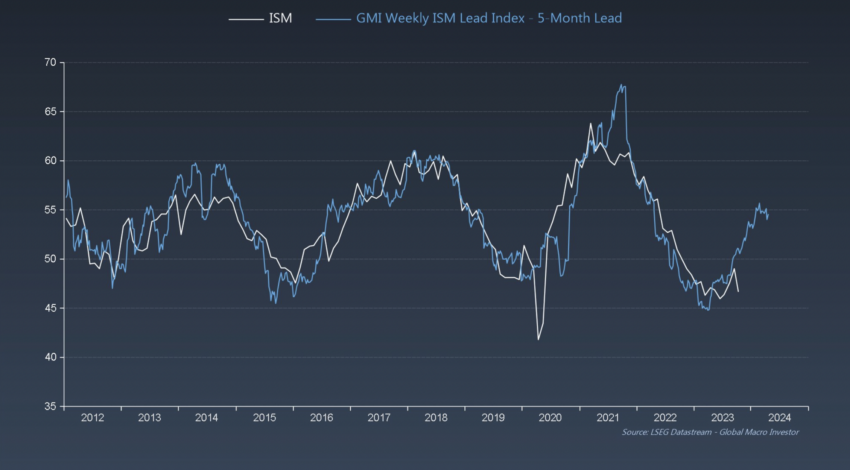

“But our Lead indicator for ISM has been rising sharply. This is generally where the SPX lives (part cyclical, part growth) and explains the SPX strength vs Russell 2000 (RTY) or commodities…”

Moreover, he predicts that within a year, the crypto market could experience significant growth.

“Using our GMI Financial Conditons Index, we can peer 11 months into the future, suggesting a strong year in 2024. This is where the growth assets of NDX and Crypto live. This is why they bottomed before everything else…”

Read more: AI Stocks: Best Artificial Intelligence Companies To Know in 2023

Meanwhile, a researcher for K33 Research, Vetle Lunde outlines that the expectations on the Chicago Mercantile Exchange (CME) are that the price of Bitcoin will rise in the future:

“CME is very long. ATH OI, massive premiums,” Lunde stated.

He further points to the difference between the spot price of Bitcoin and the futures contract as a good indicator of bullish sentiment:

“BTCs next month contract has only traded on wider premiums vs. its front month contract on three occasions since its launch.”

Recent Buzz Surrounding the Upcoming Bitcoin Halving

There has been much speculation in recent times over how the crypto market will perform in the next twelve months. This is especially so, given the expected Bitcoin halving in April 2024.

On November 12, BeInCrypto covered analysts’ forecasts on taking advantage of a turning market. Furthermore, turning small amounts of Bitcoin into large six-figure sums.

According to one analyst’s model, traders should purchase Bitcoin six months before the halving and sell 18 months after.

This allegedly aims to leverage Bitcoin’s cynical patterns, capturing significant price increases surrounding the Bitcoin halving while avoiding subsequent bear markets.

Read more: Which Crypto Sectors Boom During the Holidays? A Guide for Traders

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link