November’s CryptoSlate Alpha snapshot: Navigating crypto’s regulatory maze and economic uncertainties

[ad_1]

Welcome to the CryptoSlate Alpha November Snapshot, a collection of the month’s most pivotal research, insights, and market reports. This content, central to understanding the evolving crypto landscape, is available exclusively to our subscribers who stake at least 20,000 ACS tokens in our Access Protocol pool on Solana.

This edition delves into the challenges and opportunities awaiting the crypto sector in 2024. Our key report, “Crypto’s Crucial Year: Overcoming 2024’s Regulatory and Economic Challenges,” examines how the industry prepares for regulatory shifts and economic uncertainties, especially in the context of the upcoming Bitcoin halving.

We also present an in-depth analysis of prominent layer-1 blockchains like Solana, Avalanche, and Cosmos and explore the implications of BITO’s performance for the future of Bitcoin ETFs. Additionally, our insights cover the intriguing phenomena of yield curve inversions and their impact on crypto markets.

Our research articles highlight significant trends such as the declining ETH/BTC ratio, shifts in Bitcoin’s market dominance, surges in Solana’s user engagement, and the resilience of Bitcoin at critical price points. We also analyze the repercussions of Binance’s recent SEC fine and its influence on futures trading.

Join us in exploring November’s critical developments in the crypto sphere. With CryptoSlate Alpha, you’re always one step ahead.

November α Market Reports

Crypto’s crucial year: Overcoming 2024’s regulatory and economic challenges

The crypto industry prepares for a defining year with regulatory hurdles and economic uncertainty ahead.

Breaking down L1 blockchains: A deep dive into Solana, Avalanche, and Cosmos

Analyzing the intricacies and innovations of Solana, Avalanche, and Cosmos as they redefine the layer-one blockchain landscape.

What does BITO say about the fate of a spot Bitcoin ETF?

Exploring the performance of BITO to understand if it could serve as an indicator for the future performance of a spot Bitcoin ETF.

Decoding the economic signals of an un-inverting yield curve

Exploring the phenomena of inversion and un-inversion of the yield curve.

November α Research Articles

Decline in ETH/BTC ratio shows Bitcoin’s rising market dominance

Ethereum’s post-Merge slump versus Bitcoin’s rally reflected in a declining ETH/BTC ratio.

U.S. reclaims dominance in Bitcoin market despite supply shift

Shift in Bitcoin’s supply and price influence points to a concentrated U.S. market power.

Solana’s user engagement surges with influx of new participants

A multi-tiered user base emerges as Solana experiences significant engagement and transactional variance.

Bitcoin miners see 19-month high in revenue as halving nears

A surge in Bitcoin miner revenues suggests a profitable lead-up to the network’s halving event.

Bitcoin’s resilience at $37k backed by strong accumulation trend

Bitcoin holders expand their grip amid market recovery.

Binance turmoil leads to record futures activity – analyzing the impact

Trading volumes in Bitcoin futures and perpetual contracts surge in wake of Binance’s $4 billion SEC fine.

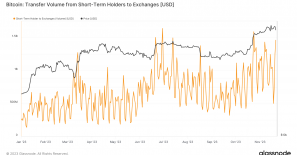

Surge in Bitcoin exchange deposits breaks six-month withdrawal streak

Bitcoin holders pivot to exchanges, reversing six-month withdrawal trend.

Transactions on Avalanche surge by 3,040% in November

Further, Avalanche’s expanding user base shows 30x increase in transactions per second.

Surge in Bitcoin hash rate signals strong miner commitment before 2024 halving

Bitcoin’s impending halving triggers a mining frenzy as hash rate hits new highs.

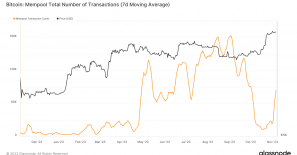

Mempool overload leads to skyrocketing Bitcoin transaction costs

Transaction backlog and fee inflation mark Bitcoin’s network challenges amid rising popularity of Inscriptions.

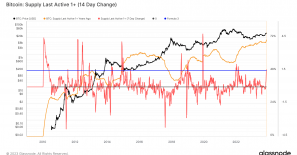

Analyzing Bitcoin’s supply trends as surge in long-term Bitcoin holdings points to investor confidence

Supply shift reveals Bitcoin moving from short-term trades to long-term holds.

Ethereum’s blue chip DeFi tokens poised for growth

Key metrics predict a positive shift for Ethereum’s DeFi ecosystem as user adoption aligns with rising transactions.

Ethereum and Solana lead DeFi surge as TVL and DEX activity soar

Solana’s 89.31% TVL growth signals rising star status in DeFi sector, but Ethereum remains the sector’s biggest player.

Bitcoin’s realized profits surge as market braces for 2024 halving

Bitcoin’s realized cap has hit $407 billion as investors lock in profits ahead of the 2024 halving.

Bitcoin futures volume surges 157% as BTC crosses $37k

The total volume of Bitcoin futures traded jumped from $27.69 billion to $71.29 billion, showing an increase in speculative activity.

BlackRock Ethereum ETF sparks surge in ETH/BTC ratio

The ETH/BTC ratio’s spike and the increased trading activity mean heightened market attention for Ethereum following BlackRock’s ETH ETF filing.

Bitcoin’s climb above $35,000 followed by surprisingly measured market

The put/call ratio’s gradual increase reflects a market that, while still bullish, is becoming more cautious.

Rising Bitcoin Inscriptions activity signals shift in transaction types

A surge in Bitcoin Inscription activity is placing pressure on the network.

Gold remains stable while volatility rocks Bitcoin and Ethereum’s 2023

Gold’s steady performance contrasts with Bitcoin and Ethereum’s high volatility, underscoring differing investment narratives.

Perpetual futures market paints a rosy medium-term picture for Bitcoin

High demand for Bitcoin futures indicates over-leveraged market ramping up for a bull run.

A month in review: Solana’s DeFi protocols break new ground

Solana’s DeFi protocols see impressive user growth and token appreciation.

Unpacking Solana’s surge in the shadow of Bitcoin rally

The significant growth in TVL, driven largely by Marinade Finance, highlights Solana’s potential, but also raises questions about its reliance on a few major protocols.

Grayscale’s GBTC paradox: Performance at a discount

Persistent discount on Grayscale Bitcoin Trust could suggest growing market desire for a U.S. spot Bitcoin ETF.

November Top α Insights

Long-term holder trends suggest crypto markets could be headed for a bull run

Unpacking Bitcoin’s previous cycles reveals long-term trends that could potentially signal new market phases.

Upcoming Bitcoin halving may put Ethereum’s inflation rate in the shadow

Bitcoin’s upcoming 2024 halving expected to outshine Ethereum’s inflation rate.

After FTX shock, Bitcoin holders brace for the long haul with record dormancy

Long-term holder milestone nears as 15 million Bitcoin remain steadfast amid market shifts.

Bitcoin miners transfer 8,000 BTC amid transaction fee surge

Bitcoin miner balances see sharp drop amid transaction fee spikes and potential selling anticipation.

Bitcoin and crypto overcoming hurdles pre-2024 halving

Crypto markets navigate regulatory pressures, eyeing potential boost from 2024’s economic outlook.

Historic bubbles burst while Bitcoin bounces back

Unlike Tulip Mania, Bitcoin has rebounded from severe drawdowns multiple times.

Market reacts to Binance news as short-term Bitcoin holders cash out

Long-term and short-term Bitcoin holders react markedly to CZ and Binance news, triggering a significant sell-off.

Recent on chain data points to an all-cohort Bitcoin accumulation

Bitcoin sees aggressive accumulation akin to bear market bottoms and bull market peaks.

All Bitcoin cohorts are in profit for the first time since October 2021

Profitable withdrawals shift crypto market sentiment as investors pivot to gains.

Bitcoin price rally ignites bullish sentiment across US and Asia

U.S. and Asian markets showcase strong bullish trends as Bitcoin soars past $35,000.

Inscriptions cause sudden surge in Bitcoin mempool transactions

A surge in Inscriptions pushed the 7-day average Bitcoin mempool transaction count above 70,000.

Surging to $113 trillion, Bitcoin on-chain settlement showcases extraordinary growth

Bitcoin adoption milestone: 50 million addresses with non-zero balances imminent

Year-end Bitcoin options poised for bullish close with $5.7 billion expiry

Bitcoin traders are showing optimism with roughly $350 million bet on a $45K strike price for year-end 2023.

Gold and Bitcoin rally as traditional economic indicators falter

Rising inflation and US debt shift focus to hard assets like gold and Bitcoin, with Bitcoin soaring 120% year to date.

Historical correlation between elections and recessions raises concerns ahead of 2024

Historical data shows that U.S. elections and recessions have typically occurred within close temporal proximity to each other.

Market maturity: Bitcoin investors stay calm amid 5% value fluctuation

Despite Bitcoin’s dip, short-term holders’ losses limited compared to past sell-offs.

Aging population could increase sell pressure on stocks and bonds

Baby boomer retirement trends may trigger asset liquidation amid shifting demographics

Bitcoin’s 4-year compound growth doubles since September low

Bitcoin experiences a 50% increase in 4-year compound growth, igniting debates on future profitability.

November sees Bitcoin soar 7%, topping year-to-date highs amid U.S. bullishness

Amidst turbulent liquidations, Bitcoin achieves a positive November for the first time since 2017.

Binance sees whale outflows and retail inflows amidst leadership shuffle

Changpeng Zhao’s departure from Binance has been followed by a split in investor behavior, with whales exiting as retail flows in.

The post November’s CryptoSlate Alpha snapshot: Navigating crypto’s regulatory maze and economic uncertainties appeared first on CryptoSlate.

[ad_2]

Source link