Tether Stablecoin: How USDT Crypto Works + Controversy

[ad_1]

Tether (USDT) stablecoin is one of the cryptocurrency market’s biggest controversial topics in the bitcoin community. Master The Crypto put together a three-part guide for you to review to better understand Tether, how Stablecoins work and the Bitfinex association/price manipulation drama. Let’s begin:

- 1) what is Tether stablecoin (USDT)

- 2) how Stablecoins work + stablecoin comparison with Facebook Libra competition

- 3) the full story of the Tether crypto token and Bitfinex exchange, and what’s next

Live Tether Price: USDT Coin Market Cap

Live Tether Price vs Bitcoin: USDT Stablecoin Market Cap + Trading Volume

#CoinPriceMarketcapVolume (24h)SupplyChangeLast 24h

Tether (USDT)

Tether, who’s official website is at tether.to, is a stablecoin cryptocurrency by the token symbol of USDT to represent a 1:1 USD-pegged US Dollar token. As the Tether crypto slogans put it, a ‘digital money for a digital age’, with its aim to ‘bring real world currency to the blockchain’, USDT is one of the most highly-debated community topics.

The number of cryptocurrencies has exploded since the advent of Bitcoin back in 2008. With 11 years separating it from its very humble beginnings, there is now an enormous number of digital assets within the market. These different currencies either set themselves apart with unique functions or simply seek to capitalize on the success of these virtual currencies.

While these different assets provide intrinsic value to their multitudes of users and investors, another ‘genre’ of digital currency has managed to grow at an impressive rate too. Being backed by a sovereign currency, Stablecoins have emerged over the past few years as an almost extension to popularly known currencies like the US Dollar, as one example.

It should be said, these stablecoins haven’t exactly managed to explode in the same way as digital assets, but there are some pretty interesting iterations out there that are worth considering. One of these, of course, is Tether (USDT) which is one of the more popularly used stablecoins among those interested in using, holding or even loaning it out. And no matter where you check the price of Tether, whether CoinMarketCap, CryptoCompare or CoinGecko to name a few, you will see USDT in the top 10 if not top 5 by market cap and an alternating trading volume rank with Bitcoin for #1 and #2 for most in the blockchain-based token ecosystem.

But how exactly did Tether get started? What’s the underlying logic behind using it? And how exactly are you supposed to get a hold of it? We’re going to be diving into these questions right here and right now.

Quick Context – About Stablecoins

One of the interesting things about Stablecoins is that they’re not as ‘recent’ as we’d like to think; in fact, some of the first versions of these currencies actually pre-date what we know as being some of the biggest coins in the crypto world.

For example, some of the first stablecoins out there was introduced to the community back in 2014, including Tether which was first released in July 2014 under the name ‘RealCoin’. Also included were BitShares (BitUSD) and Nu (NuBits) which were able to provide users with a liquid virtual asset with a fixed price thanks to the fact that it held a reserve of US Dollars which operated as a kind of crypto collateral.

To simply say ‘crypto collateral’ is to deeply simplify the often complicated system of liquidity that some of these stablecoins have, which can range from a singular reserve of US Dollars, to a mixed range of holdings from US Dollars, to crypto-assets like Pooled Ethereum.

Regardless, stablecoins provide their own unique take on a stable economic system. And the same is true of Tether, which we’ll be diving into now.

Tearing into Tether – An Origin

Tether is interestingly what we would describe as a brainchild of a number of the senior management team behind the cryptocurrency exchange – Bitfinex. While we know this now, the actual management team remained hidden from the general public when it was first introduced back in 2014, having started off as ‘RealCoin’ before being re-branded as ‘Tether’ in November of the same year.

So what exactly is Tether? According to its white paper, Tether operates as a kind of stablecoin that gives users the ability to use the US Dollar on both the Ethereum and Bitcoin blockchains.

“A digital token backed by fiat currency provides individuals and organizations with a robust and decentralized method of exchanging value while using a familiar accounting unit. The innovation of blockchains is an auditable and cryptographically secured global ledger.

Asset-backed token issuers and other market participants can take advantage of blockchain technology, along with embedded consensus systems, to transact in familiar, less volatile currencies and assets.

In order to maintain accountability and to ensure stability in exchange price, we propose a method to maintain a one-to-one reserve ratio between a cryptocurrency token, called tethers, and its associated realworld asset, fiat currency. This method uses the Bitcoin blockchain, proof of reserves, and other audit methods to prove that issued tokens are fully backed and reserved at all times.”

One of the interesting things about Tether comes back to this easy application on both Bitcoin and Ethereum. While its contemporaries exist sometimes within their own blockchain as a self-contained system such as MakerDAO, Tether is different due to the fact that the majority of its virtual tokens exist and routinely operate on Bitcoin and Ethereum’s blockchain’s respectively; amounting to 97 percent of its token movements.

So why is this the case? It’s a popularly used token made accessible to investors and potential buyers by a variety of centralized and decentralized exchanges.

The logic behind this is pretty simple – it provides a good speculative hedge for buyers in case there’s a bearish turn in the main crypto market; for investors, it allows them to fall back to a reserve asset that won’t fluctuate in value if they chose to leave it in there. But this also allows them to easily move from one currency to another.

For cryptocurrency exchanges – the availability of Tether provides an additional layer of liquidity for their exchange, which is especially important as a smaller centralized or decentralized exchange.

What makes this a little strange is the fact that it, from a financial perspective, it doesn’t make that much sense to piggyback off these two blockchain protocols. By contrast, other stablecoins simply develop and launch their own database.

In doing so, they can mitigate any additional costs that may come from dealing with, for example, miners in accordance with the proof of work consensus mechanism used both by Ethereum and Bitcoin.

This 97 percent metric doesn’t really sound like much, but what gives it some really heavy impact is when we take time to consider the fact that Tether’s token, the USDT, is backed on a 1:1 ratio with the dollar. And with 2.2 billion of them in circulation, it means that Tether carries a reserve of at least the same amount.

Why use Tether?

Much as was previously described, there’s a good deal of value in having a digital currency attached (in some way) to a sovereign currency. For coin exchanges and users alike, this specifically includes having some kind of financial hedge in the crypto market.

But the same advantage goes for those companies and retailers looking to accept cryptocurrencies from potential customers. As we’ve seen from the likes of Microsoft and Expedia among others, there’s every motivation to make purchases in crypto, but there are some serious issues that come with trying to do so.

Firstly, there’s a lot of volatility that comes with trying to take payments for products in Bitcoin. Secondly, the third-party payment systems that operate to provide this solution in a more accessible way basically negates the value of taking crypto as a means of payment; so why bother?

Tether aims to bridge this divide between merchants and everyday users by offering the best of both worlds; a digital currency that can piggyback off Bitcoin or Ethereum, which is also backed by a stable(ish) sovereign currency.

For exchanges, having some kind of open door for users interested in buying cryptocurrencies to quickly translate real-world cash into the digital kind is why Tether managed to take off among exchanges as one other example.

The exchanges and companies that strive to offer Tether can actually find themselves a far larger market for those interested in investing, and this may prove advantageous in the near future.

Compared to any other kind of stablecoin, Tether is the most popular kind of token being used within the ecosystem compared to other kinds out there.

So how Does Tether Work?

Tether currently operates on top of the Omni Protocol, which is a commonly used one for those digital assets that sit on top of and use the Bitcoin blockchain. While the underlying premise of Tether (USDT) is that it operates as a digital translation of the US Dollar, it doesn’t exactly function in the same way.

Firstly, while the US Dollar, for all intents and purposes, remains relatively stable while it’s in your pocket. USDT is subject to some level of fluctuation but manages to sit back on or closely orbiting $1.

So how is it that it actually works? Hypothetically, if a user were to directly wire money to a cryptocurrency exchange like Kraken, they will be provided with the same amount in Tether. The same users can then take this amount of USDT and complete transactions for other kinds of cryptocurrencies.

While this used to be the case for all users looking to get hold of Tether, this is not longer the case, due to banking problems that the company suffered over the past few years.

So, this is how it USED to work. How does it work now? While it doesn’t get involved with these kinds of transactions anymore, it still operates on the Omni Protocol, which is a layer-2 solution.

It’s on Tether’s technical stack that we can see the new process; which is that while Tether circulates on Omni, users can obtain their own volumes of Tether through a mixture of Decentralized exchanges, and centralized ones that have managed to become an accepted issuer or custodian for the stablecoin.

For those that are interested in actually obtaining Tether, here are some of the exchanges that currently offer them:

- Kraken

- Binance

- Bithumb Global

- Bittrex

- KuCoin

- Gate.io

- Bitsdaq

- BTCTurk

- UpBit

- Max Maicoin

- OmgFin

- BitoPro

- IndoDax

- CITEX

- WazirX

- Kuna Exchange

- BitSonic

- FTX

- PieXGo

Each of these exchanges currently offers Spot Trading of Tether, with others out there that provide users with Futures trading too.

Tether’s Controversies

For these first three years, no-one knew who was behind this project exactly. That was until 2017, when Tether finally and unusually published its own ‘About us’ page between the weeks of the 5th and 17th of December. With this having finally been revealed, it turned out that the major members of this project came from the Bitfinex team; specifically:

- JL van der Velde (CEO)

- Giancarlo Devasini (CFO)

- Philip Potter (CSO)

- Stuart Hoegner (general counsel)

- Matthew Tremblay (chief compliance officer)

Bitcoin Price Fixing

Now, this could be simply shrugged off as members of a passionate cryptocurrency community looking to level out the playing field for new players in their community. The problem is that there are certainly enough fingers pointing at the Bitfinex team to suggest that there’s more to it than just this.

Being the minds behind a cryptocurrency exchange, AND and easily accessible kind of stablecoin that can be put to use on said exchanges is something that is more of an actual threat than a theoretical one.

This is something that the Bitfinex team certainly acted upon, according to news sources like Bloomberg which reported on it at the time, and the United States Justice Department and its Commodities and Futures Trading Commission back in November 2018.

These concerns, pokes and prods by the CFTC and Justice Department come from the aftermath of the Bitcoin hyper-bull experienced back in 2017. There were pretty serious allegations that Bitfinex, through its direct ties to Tether, were making use of the stablecoin to support or, possibly, fueling the rally within the market in 2017.

Here’s what Bloomberg had to say about the matter during the time:

“Some traders — as well as academics — have alleged that these Tethers are used to buy Bitcoin at crucial moments when the value of the more ubiquitous digital token dips. JL van der Velde, the chief executive officer of Tether Ltd. and Bitfinex, has previously rejected such claims.”

It’s CEO also replied with the following about allegations of Tether’s use in potential price-fixing:

“Tether issuances cannot be used to prop up the price of Bitcoin or any other coin/token on Bitfinex.”

Then there was the June 25, 2018 research report “Is Bitcoin Really Un-Tethered?” by University of Texas at Austin’s Department of Finance John M. Griffin and Ohio State University’s Amin Shams that was recently updated in November 2019 making multiple claims and assumptions towards manipulating the crypto market and the bitcoin price. There is also the new report out by Carol Alexander and Michael Dakos titled, “A Critical Investigation of Cryptocurrency Data and AnalysisA Critical Investigation of Cryptocurrency Data and Analysis” that was released in May 2019.

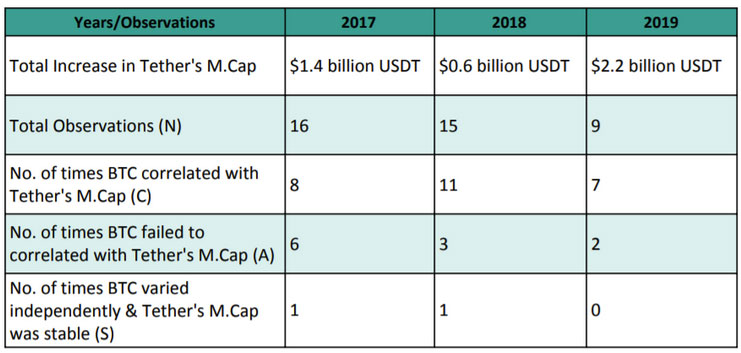

Here is a chart outlining Tether issuance in 2017, 2018 and 2019 showing the amounts printed along with the number of times bitcoin has correlated with the USDT market cap increases (note that correlation doesn’t always equate to causation):

Much of this riddle is still playing out at the time of this Tether crypto review, but now that we have a leg in the USDT stablecoin world, let’s take a full step in and understand how stablecoins work and compare Tether to other dollar-pegged crypto coins, as well as touch on what the Facebook Libra stablecoin will do towards Tether.

What is a Stablecoin? What Are the Biggest and Most Popular Stablecoins? How Do Stablecoins Work? Find Out Everything You Need to Know About Stablecoins

Stablecoins are digital tokens that peg their value to a specific asset – like the US Dollar. As the crypto industry continues to grow, we’ve seen surging demand for stablecoins.

Despite the surging demand for stablecoins, many people continue to be totally clueless about how stablecoins work. What is a stablecoin? Which stablecoins are the best and most trusted on the market? In this guide, we’re answering all your questions about stablecoins.

What is a Stablecoin?

A stablecoin is a digital token built from the ground up to have a steady value. Many stablecoins are pegged to the US Dollar simply because it is the world’s most widely-used currency. However, we’ve also seen stablecoins pegged to all types of large and small fiat currencies.

Some stablecoins aren’t pegged to any fiat currency, nor are they tied to any national economy. They use smart contracts to balance reserves, for example. The smart contract sells stablecoins when prices are high, then buys stablecoins from the market when prices are low.

Why Do We Need Stablecoins?

Stablecoins were a necessary addition to the crypto community. Stablecoins emerged for a number of important reasons. However, the two most important reasons we needed stablecoins were:

Crypto Volatility

Bitcoin and other cryptocurrencies are notoriously volatile. It’s currently difficult for businesses, merchants, or individuals to accept bitcoin because the value can fluctuate significantly on a day-to-day basis. Let’s say a dealership buys a car from Honda for $20,000, then sells that car for 2 BTC a few days later. As long as 2 BTC is equal to $20,000, the dealership is okay. If the value of BTC drops, however, then the dealership could be out thousands of dollars.

Regulatory Scrutiny of Fiat Currencies

Crypto exchanges that handle ‘real’ USD or other fiat currencies often face greater regulatory scrutiny. Because of this regulatory scrutiny, some exchanges block all fiat trading whatsoever. Fiat-pegged stablecoins allow traders to enjoy the benefits of fiat currency trading without certain regulatory hurdles.

How Do Stablecoins Work?

Today, stablecoins work in different ways to retain a stable value.

Tether, for example, is one of the best-known stablecoins on the market. It’s pegged to the USD at a ratio of 1 US Dollar Tether (USDT) to 1 USD. Tether retains its value by holding a reserve of USD assets.

Originally, Tether claimed to hold every USDT 1:1 with cash reserves. In other words, for every $1 billion of USDT on crypto markets, Tether held $1 billion in liquid cash in its bank account. That claim quickly proved to be false, and Tether now simply claims that the USDT is backed by equivalent “cash and other assets” instead of strictly cash reserves.

Some stablecoins stay stable with built-in algorithms or smart contracts. When the value of the stablecoin drops below a certain amount, the smart contract buys stablecoins from the market, driving up prices. When the value of the stablecoin rises above a certain value, the smart contract sells the stablecoin to reduce market demand.

Other stablecoins use even more complex systems involving a complex set of algorithms, buyback programs, and fiat reserves. As the stablecoin world continues to expand, we’re seeing new and novel stability mechanisms in place.

Benefits of Stablecoins

Some of the benefits of using, holding, or trading stablecoins include:

Better and Easier Mainstream Adoption of Crypto: Try walking down to Subway and telling the sandwich artist you’ll pay 0.0005 BTC for a foot long sub. Good luck. Everyone has now heard of bitcoin, but few people can immediately picture the value of bitcoin like they can picture the value of USD or other major fiat currencies.

You Don’t Pay Rent or Buy Groceries in Bitcoin: The vast majority of the world doesn’t pay rent or buy groceries in bitcoin. Unless something dramatic occurs within the next few years, this system is not going to change in the near future. As long as people pay rent, buy groceries, and manage other daily necessities in major fiat currencies, we’re going to need some type of easy fiat-to-crypto conversion mechanism.

Hedge Markets: Let’s say you’re holding bitcoin. You’re a big believer in the technology – but you also believe a market correction is coming. A smart trader would hedge her position by selling some BTC for an asset with a stable value – like a stablecoin. You sell 1 BTC for $10,000 USD worth of a stablecoin. BTC falls to $5,000 per BTC a few weeks later. Then, you sell your stablecoin back into BTC and end up with 2 BTC instead of 1. Put simply, stablecoins give traders more options and a better ability to hedge markets.

Stability: Thousands of merchants now accept bitcoin and other cryptocurrencies. However, widespread adoption of bitcoin is hindered by bitcoin’s instability. A merchant may not want to accept 1 BTC for a product today when the vendor still works in cash. When volatility is high, it’s difficult to use an asset as a currency.

Buy Stocks with Stablecoins: Some crypto markets have taken things to the next level, allowing you to hold cryptocurrencies, stablecoins, and stocks within one convenient dashboard. These marketplaces rarely let you buy stocks directly for BTC, however, and you may have to transfer money from crypto into a stablecoin first.

Legal and Regulatory Benefits: There are plenty of legal and regulatory benefits to using stablecoins. Namely, stablecoins aren’t necessarily backed by the same trading restrictions as cash reserves. It’s often easier for an exchange to use a proxy currency – like the USDT – instead of directly handling USD cash.

It’s Still Decentralized: Stablecoin critics might claim that stablecoins are just creating a different version of cash. That’s not quite true, however. Many stablecoins track the USD and other fiat currencies; other stablecoins, however, track other assets or no assets whatsoever. A good stablecoin has a decentralized governance system that appeals to crypto advocates.

Blockchain-Based Digital Tokens: Most stablecoins are blockchain-based, which is why they can be easily traded among crypto exchanges. Stablecoin traders get the best of both worlds, enjoying the security and decentralization of blockchain-based tokens along with the stability and familiarity of fiat currencies.

Types of Stablecoins

There are a number of different types of stablecoins available today. Generally, however, stablecoins fall into two broad categories, including collateralized and non-collateralized stablecoins.

Collateralized Stablecoins

Collateralized stablecoins are stablecoins backed by some asset. That asset has value, and each unit of the asset is tied to a specific amount of stablecoin. With USDT, for example, each USDT is backed 1:1 with USD cash. Each unit of Tether is fully collateralized. Other stablecoins are collateralized by cryptocurrencies – not fiat currencies.

Fiat Collateralized: Fiat collateralized stablecoins use fiat currency as collateral. Tether has USD reserves, for example, and allows traders to exchange a USDT 1:1 with a USD. This is why Tether has value. Other fiat-collateralized stablecoins work in a similar way. If there’s $1 million worth of stablecoin in circulation, then there’s $1 million in a vault backing the value of that stablecoin.

Crypto Collateralized: Some stablecoins are baked by cryptocurrency reserves. MakerDAO’s lending platform is backed by ETH, for example, and users are required to lock up 150% ETH to borrow the Dai stablecoin. Because of this, each Dai is collateralized by ETH at a minimum ratio of 150%.

Asset Collateralized: There’s a third type of collateralized stablecoin. Asset collateralized stablecoins aren’t backed by fiat currencies or cryptocurrencies; instead, they’re backed by some other type of asset. They might be backed by gold bars, for example, or stocks and other assets.

Non-Collateralized Stablecoins

Some stablecoins aren’t collateralized at all. There’s nothing specific backing the value of the stablecoin. The stablecoin’s value isn’t pegged to the USD, EUR, BTC, or any other traditional asset; instead, it’s backed by algorithms, smart contracts, or some other unique technology.

These stablecoins may be the most intriguing option available moving forward. They use advanced blockchain technologies and decentralized, automated smart contracts to enforce specific rules. Theoretically, a well-designed non-collateralized stablecoin could hold its value indefinitely regardless of broader crypto or fiat market movements.

Disadvantages of Stablecoins

Stablecoins are far from perfect. Like other emerging technologies, stablecoins have already started to show certain warts. Some stablecoins have crumbled out of the gates. Other stablecoins – even large ones like Tether – continue to face questions over their stability, legitimacy, and transparency.

Some of the disadvantages of stablecoins include:

Fiat Collateralized Stablecoins Work Just Like Banks

Why would a private company hold a reserve of $1 million USD in cash just to support the value of a stablecoin? There’s no incentive to hold this money in cash, and the company is losing money every day due to inflation. To make holding that money worthwhile, the company would have to lend out the cash or invest it.

Put simply, there’s no incentive for anyone to hold cash in a bank reserve just to support a stablecoin. Despite this seemingly obvious conclusion, companies like Tether originally claimed to be doing exactly that. Tether claimed that they held billions of dollars’ worth of USD cash held in a bank to support every USDT stablecoin in circulation. If that was true, then Tether was losing tens of thousands of dollars every day just through inflation.

Tether would alter change its tune, claiming that they hold their USD reserves in “cash and other assets”. Tether now appears to be investing its cash reserves to earn interest. Of course, investing always comes with a certain degree of risk. If Tether makes a bad investment, then the value of the USDT could plummet.

All of this adds up to a simple conclusion: certain fiat collateralized stablecoins are working just like banks. Did we really go through all of the trouble of creating blockchain and cryptocurrencies just to launch a new lending and banking system?

Aren’t We Just Re-Creating Money? What’s the Point?

Between 1879 and 1933, every USD in circulation was backed by a specific amount of gold. In 1933, however, President Franklin Delano Roosevelt took the United States off the gold standard after a series of bank failures during the Great Depression. The price of gold was raised to $35 per ounce, theoretically stabilizing the value of the USD. That price point was held until 1971, when President Nixon announced that the United States would abandon the gold standard. Since then, the US Dollar has not been pegged to the value of gold and vice versa. Critics say stablecoins are just re-creating the gold standard systems of times gone by. Some people say this is a good thing because it gives currency concrete value. Others claim it holds back economic progress.

Stablecoins Haven’t Proven Themselves in True Market Crashes

It’s easy for stablecoins to claim stability during normal market conditions. Yes, markets have gone up and down over the last two years, but we haven’t seen any type of significant crash. Stablecoins only started to become popular after crypto’s rise to $20,000 and subsequent drop to the $5,000 to $10,000 range in late 2017 and early 2018.

Will stablecoins hold their value if bitcoin shoots up to $50,000 or drops to $1,000? Will stablecoins hold their value if the USD plummets and we enter another international recession? These are all good questions that may never be answered.

A ship is safest when it’s in the harbor – but that’s not where a ship is meant to be. A stablecoin is safest in stable market conditions, but we don’t know how it will perform until it faces significant volatility.

Scams and a Lack of Transparency

There’s another problem with the stablecoin industry: it’s faced issues with scams and a lack of transparency – similar to the broader crypto market in general.

No stablecoin has faced as much criticism as Tether. Tether was founded in a haze of secrecy, with its founding team linked to various shady banks and exchanges like Bitfinex. Then, there was the controversy over Tether’s cash reserves, including how much cash Tether was really holding in its reserves.

Part of the problem of Tether was its sudden rise to popularity. All of a sudden, a small group of people had the ability to print $100 million USD out of thin air whenever they felt like it. Tether claimed this money was always backed 1:1 with real USD cash reserves, but audits were rare.

If you had the ability to print $100 million for yourself overnight, wouldn’t you take it? This is one reason why stablecoins may never work without a proper, decentralized regulation system in place.

The Best Stablecoins Are Centralized

Another problem with stablecoins is that the biggest stablecoins are often centralized. They were built by specific exchanges – like Gemini. Or, they’re fully operated and controlled by a centralized entity like Tether.

Yes, people have tried to create decentralized stablecoin systems, and many of these systems show a lot of promise. If we were able to create a decentralized currency like bitcoin that can’t be shut down or controlled by any entity, then why can’t we create a decentralized stablecoin? That’s the optimistic take – and it’s one that could come true.

Top 14 Stablecoins

![]()

There are about 20 major stablecoins bought and sold across today’s cryptocurrency exchanges. Tether, with a market capitalization of over $4 billion, is the most popular and widely-traded stablecoin by far.

Other stablecoins, however, have shown increasing promise. They continue to grow. Exchanges are supporting newer stablecoins based on their transparency and legitimacy. Generally, the community trusts companies like Gemini more than it trusts companies like Tether.

With that in mind, here are the top ten stablecoins available today.

Tether (USDT)

- $4.01 Billion Market Cap

- $18.4 Billion 24h Trading Volume (September 2019)

- Pegged to USD

- Fiat Collateralized

- Operated by Tether

USD Coin (USDC)

- $436.28 Million Market Cap

- $172.7 Trading Volume (September 2019)

- Pegged to USD

- Fiat Collateralized

Paxos Standard Token (PAX)

- $241 Million Market Cap

- $383 Million Trading Volume (September 2019)

- Pegged to USD

- Fiat Collateralized

- Operated by Paxos Trust Company

TrueUSD (TUSD)

- $190.94 Million Market Cap

- $637 Million Volume (September 2019)

- Pegged to USD

- Fiat Collateralized

- Operated by TrustToken

Dai Stablecoin

- $80.05 Million Market Cap

- $4.57 Million Trading Volume (September 2019)

- Pegged to USD

- Crypto Collateralized

- Operated by MakerDAO

USDK (USDK)

- $28.45 Million Market Cap

- $40.1 Million Trading Volume (September 2019)

- Pegged to USD

- Fiat Collateralized

- Operated by OKLink

Stasis EURS (EURS)

- $35.46 Million Market Cap

- $387,225 Trading Volume (May 2019)

- Pegged to EUR

- Fiat Collateralized

- Operated by Stasis

bitCNY (BITCNY)

- $9 Million Market Cap

- $151,000,000 Trading Volume (May 2019)

- Pegged to CNY

- Crypto Collateralized

- Operated by Unknown Company

Gemini Dollar (GUSD)

- $8.5 Million Market Cap

- $2.87 Million Trading Volume (September 2019)

- Pegged to USD

- Fiat Collateralized

- Operated by Gemini

StableUSD (USDS)

- $6.4 Million Market Cap

- $678,000 Trading Volume (May 2019)

- Pegged to USD

- Fiat Collateralized

- Operated by Stably

USDQ

- $5.49 Million Market Cap

- $119,000 Trading Volume (September 2019)

- Pegged to USD

- Fiat collateralized

- Operated by Platinum Securities

BitUSD (BITUSD)

- $3.87 Million Market Cap

- $650,000 Trading Volume (September 2019)

- Pegged to USD

- Crypto Collateralized

- Operated by BitShares

1SG (1SG)

- $1.3 Million Market Cap

- $3,800,000 Trading Volume (May 2019)

- Pegged to SGD

- Fiat Collateralized

- Operated by Mars Blockchain Group

sUSD (SUSD)

- $1.3 Million Market Cap

- $115,000 Trading Volume (May 2019)

- Pegged to USD

- Fiat Collateralized

- Operated by Synthetix

Other Stablecoins

The stablecoins listed above are the most popular ones on the market today. They each have a market cap over $500,000. The stablecoins listed below, meanwhile, have smaller market caps but may become more prominent in the future:

- Alchemint Standards (SDS)

- White Standard (WSD)

- NuBits (USNBT)

- Constant (CONST)

- SDUSD (SDUSD)

- USDCoin (USC)

- QUSD (QUSD)

- StableCoin (SBC)

Facebook’s Upcoming Libra Cryptocurrency is a Stablecoin

Facebook has created enormous buzz after announcing its Libra cryptocurrency. What some don’t realize, however, is that Libra is actually a stablecoin.

Facebook envisions Libra as a complement to the US Dollar. The company plans to back Libra with a basket of currencies and US Treasury securities in an attempt to avoid volatility.

Facebook will also partner with various financial services. Each partner will inject an initial $10 million USD, giving Libra full asset backing on the day it opens.

New Libra currency units will be created on demand. If there is demand for $1 million more of Libra currency units, then partners within the “Libra Association” will need to contribute another $1 million.

Libra will use a distributed ledger – a blockchain – to reconcile payments between service partners.

There’s a huge difference between Libra and a traditional cryptocurrency like bitcoin, however: Libra is not decentralized; instead, it’s a centralized blockchain run by the Libra Association, which functions as a de facto central bank. In contrast, bitcoin uses a permissionless blockchain.

Facebook’s Libra appears well on track to launch in the near future. Facebook has already established the Libra Association in Geneva Switzerland. The Libra Association has 28 founding members, including Mastercard, PayPal, Visa, Spotify, Lyft, Uber, Coinbase, Andreesen Horowitz, Union Square Ventures, eBay, and other major organizations.

Although Libra has faced some criticism for its centralization, it could easily become the world’s largest stablecoin in the very near future. Stay tuned for more information about Libra as it gets closer to launch: the first version of Libra is scheduled to launch in June 2020.

Now, for the third and final part on this tether cryptocurrency guide, let’s review the drama between Bitfinex and Tether and what it means for the price of bitcoin, cryptoasset market manipulation and what is next for Tether (USDT).

For many people, Tether is a little hard to understand. Is it another currency? Is it supposed to serve as an alternative to the USD? What exactly does it do? To be honest, the reality is worse than the speculations.

Long story short, Tether is a scam, the likes of which have not been seen since Bernie Madoff went to jail. How is this? Well, I’ll prove it to you in this article.

Warning though: this will be a long article, so go get your cup of coffee, tea, or whatever your favorite drink is, and prepare to spend at least 10 minutes reading this (figured it’s better to give you a thorough in-depth insight into everything this is).

If you’re serious about investing in USDT, this is a must-read –so you don’t end up regretting it.

What’s Crypto Best Used For?

While blockchain has more valid and solid use cases, crypto’s best use case lies in its speculative properties. For the most part, people buy cryptos in the hopes that speculation will spike its prices, resulting in profits for the “investors”.

And to facilitate the trade of these tokens, hundreds of exchanges have sprung up all over the world. Buying crypto of your choice is often as simple as depositing some fiat currency and exchanging it for those tokens.

And because regardless of the exchange you choose, because it’s a whole ecosystem, prices are mostly the same –with the exception of fees and so on. Of course, with the crypto community being big on decentralization, the ecosystem isn’t unified, in the same way as the traditional finance system.

Its structure is very similar to Liberty Reserve –a once popular network of peer to peer exchanges around the world. Only this time, it’s different in the sense that there’s a shared ledger that helps them execute the transfer of value between entities around the globe.

That ledger is what is known as blockchain. It’s decentralized, so it’s not owned by anyone entity. However, in spite of this framework, the crypto community still has some links to traditional banking because people need to convert their fiat currencies to cryptos.

As a result, many exchanges have some sort of relationship with banks. This is why bitcoin exchanges struggle with this –they often need to comply with Know Your Customer and Anti-Money Laundering regulations.

Ironically, this goes against the very grain of cryptocurrency –a private, permissionless, trustless and regulation-free currency that’s globally acceptable. This way, there can be the transfer of money between multiple entities without the need for permission, compliance or identity.

Unfortunately, there’s little that can be done about that right now. So, the smart exchanges have adopted an approach that helps them take advantage of these regulations whilst providing their customers with the sorely needed services.

Let’s Talk About Bitfinex

One of the pioneer crypto exchanges, Bitfinex rose to prominence right after the fall of Mt. Gox –the most popular exchange at the time. Of course, this was not without its risks, which is why it became the object of hack attacks in 2016, resulting in the loss of about 120,000 bitcoins (about $70 million in cash value).

To prevent and avoid the same fate as Mt. Gox, Bitfinex, did something called a bail-in. As a result of the growing liability, they essentially created their token and offered it up as “collateral” to depositors to shore up the gap created by the stolen 120,000 bitcoins. So, customers ended up owning Bitfinex equity, thanks to the token.

These tokens were a utility token. So, people were able to trade them on the platform. And customers who wanted to, could trade in theirs for cash -1 BFX = $1USD at the time. The only problem was the company’s liquidity issues –they needed cash as quickly as possible.

Enter the Bitcoin Exchange/Wells Fargo Banking Brouhaha

At this point in Bitfinex’s operations, the company had no permanent location, even though they reportedly operated out of Hong Kong. They had multiple accounts with various banks based in Taiwan.

After the hacking incident, the primary bank –Wells Fargo- stated that they wouldn’t be clearing funds originating from and going to Bitfinex’s accounts that were domiciled with these banks. This basically crippled Bitfinex’s operations as they couldn’t execute transactions, and customers couldn’t move their funds in and out of the exchange.

As a result, they sued wells Fargo –unsuccessfully, we might add- and started utilizing a company they had, that had been quite dormant till that time. That company’s name? Tether.

Interestingly, Bitfinex had always claimed that it had no relationship whatsoever with Tether before the lawsuit. But after the lawsuit, they started using the company for their operations.

Quick Intro to Tether and How it Works

Tether is popular because of its 1:1 currency peg. So, 1USDT=$1 (or euro or GBP). So, this kind of makes it function like a stablecoin. So, unlike bitcoin and other cryptocurrencies that routinely go through price swings, Tether doesn’t –at least that’s the idea.

Bottom line, it functions like an average money market fund where you can park some of your funds without fearing significant risk. However, unlike a money market fund that’s usually backed by certain financial assets, Tether was meant to be backed by the reserve.

In other words, for every 1USDT that you buy, there’s supposedly $1 in the bank somewhere. Interestingly, Tether isn’t the only stablecoin in the market. Others have realized the potential profitability of tether and have jumped on the bandwagon, offering similar services and value.

Tether’s and other stablecoins’ USP include ease of transfer between bitcoin exchanges, safe-ish crypto harbor for parking your money when you’re not trading actively, and stability in value wherever your coins are parked.

The key thing that’s not talked about is its propensity to be used for massive money laundering activities. In fact, there are camps that believe that Tether is being used for money laundering activities.

So, it’s easy to just buy bitcoin, convert it to Tether –while bypassing the KYC process, and never worry about the value of their illegally gotten gains depreciating, no thanks to the 1:1 value peg.

Naturally, this is a very appealing notion to money laundering entities looking for a “safe space” to park their illicit gains. That, plus the fact that there’s no documentation whatsoever in the event of a hack means they cannot be traced.

However, it’s not just the fraudulent that use it. There are proponents of digital privacy, people opposed to financial regulation and compliance, tax evaders, and people who just don’t trust the government. These people make up the bulk of USDT users.

With claims of $1 reserve for every 1USDT, there’s the question of the veracity of these claims. There are strong speculations that Tether’s reserve claims are not true at all; that the firm hasn’t been in control of a significant part of its reserves.

And these folks were right. While Tether sells itself a cryptocurrency that’s backed by traditional currencies held in the reserve, court cases involving them proved that this was not the case. If anything, the bulk of their reserves originated from transactions involving known money-laundering entities such as Crypto Capital Corp and other shady entities.

So, Where Were These Funds Parked?

Between the years 2017 and 2019, avid industry watchers have asked where Tether kept the reserve it claims it has. Well, it appears that that the company largely used shell corps to move their funds around.

And some banks caught on to it, and froze their funds when they realized that the company wasn’t being straightforward with them. At the end of the day, Tether was able to finally get a bank -Puerto Rico-based Noble Bank- that was willing to take its business, and keep their funds for them.

However, this wasn’t without a few issues. For instance, the bank’s board was known to have kicked against Tether banking with them because of their relationship with known NYC-based custodial bank, BNY Mellon.

For those who don’t know BNY Mellon, this is a huge bank whose primary business involves holding assets for externally located banks in the US. So, banks with large assets that want to keep them safe, bank with them.

And as a rule, NYC Mellon has a reputation for not doing business with money launderers. So, Noble Bank’s primary worry was that NYC Mellon would dump them because of their association with Tether, effectively crippling the bank in the process.

Anyway, after they got through the initial hurdle, Noble Bank then received deposits to the tune of hundreds of millions of dollars from Tether. Naturally, that meant that their balance essentially blew up, causing some analysts to wonder how that happened in such a short period.

To cover their tracks though, Tether warned depositors against disclosing the details of the bank publicly. The goal was to avoid attracting the ire of BNY Mellon. Unfortunately, people are unpredictable, and someone ratted.

Naturally, the entire process ended up destroying Noble bank, and forced tether to look elsewhere for their banking needs. The next recipient of this reserve was Deltec Bank, which received the funds through Crypto Capital Corp.

Let’s Talk About Crypto Capital Corp

This company was a money laundering corporation with a string of crypto businesses as clients. These included Kraken, Quadriga –Canada’s largest bitcoin exchange- and Tether –their biggest client. There are also rumors that they took on Colombian drug cartels as clients.

It was able to function by locating banks with poor compliance structures and lodging the reserve in them through shell companies. Of course, when these banks found out they were being used in money laundering schemes, they close the accounts, and Crypto Capital Corp and its shell companies go elsewhere.

Of course, Tether itself denied any culpability when these issues were raised in court. They acted as though they were astounded at the Crypto Capital Corp’s MO. Whether that was true or not, was beside the point. The real point was that Tether insulated against any charges, because CCC took the fall for their actions.

Worse, CCC was working with partners, Spiral and Reggie Fowler to receive Tether’s depositors’ funds in their accounts. So, the funds didn’t even go through/to Crypto Capital Corp. It went directly to these individuals’ accounts –Reggie Fowler in particular.

So, What Impact Did This Have on Customers?

Well, customers had to follow strict instructions whenever they wanted to deposit money for Tether. First, they would have to contact Crypto Capital Corp, who would then provide them with the account details of a shell corp.

Then, they were told to send the funds with memos that would seem innocuous, and nothing related to crypto. When this is done, the customers would then have to wait until the payment is confirmed.

Once confirmed, they’ll then credit them with their Tether value. The thing about this whole scheme is even though Bitfinex claimed that it had no idea of CCC’s operations and instructions, available evidence showed that this wasn’t true. Instructions like

“[Do not share these instructions] except with your financial institution. Divulging this information could damage not just yourself and Bitfinex, but the entire digital token ecosystem. Accordingly, you are cautioned that there may be severe negative effects associated with this information becoming public.”

Were routinely sent to customers who wanted to buy Tether. This clearly showed that they knew what was happening. Unfortunately, this was the least of their problems. Further evidence showed that Reggie Fowler was actively skimming 10 percent of all deposits. This 10 percent fund was essentially how Reggie Fowler got paid for his “services”.

As usual, Bitfinex claimed ignorance of the scheme. In one of their testimonies in court, Bitfinex stated that,

“Besides a nominal fee for each deposit or withdrawal, Crypto Capital charged no fee for these services to [Bitfinex] because it was able to earn a substantial interest on the funds it held on [our] behalf in its accounts.”

However, this wasn’t true, considering that CCC never chose bankers based on their interest rates. All they were focused on were banks with lax or weak compliance. Bitfinex’s reluctance to know CCC’s workings probably resulted in their routine siphoning of 10 percent cuts.

And even if Bitfinex had been looking, this would have been difficult to notice, given tether’s continually rising balance. People who would have probably noticed would be those looking t pull out a lot of money –more than the inflows- or hackers intent on stealing.

Anyway, after banking regulators caught on to the ruse that Crypto Capital Corp had been using, they quickly froze the accounts of shell corporations linked to the company. These actions resulted in severe liquidity problems –the reason why the company couldn’t pay withdrawals.

And when word got out about their liquidity problems, withdrawals went through the roof –everyone was trying to get their funds out. The inability to transfer those funds out of CCC meant that depositors and investors couldn’t get their monies.

While the liquidity issues started in August 2018, the rumors of Tether’s insolvency didn’t start until October 2018. And the rumors were true. Long story short, the regulators froze that money and probably won’t be giving it back to Bitfinex. For those who were thinking that a repeat of the Mt. Gox settlement with the government would happen, sorry. It probably won’t.

Is there Ever a Scenario in Which Tether Had the Reserves it Claimed it Did?

Probably when they started the project. While there’s no cogent evidence that this was the case, we only have Tether’s claims to go by. Whatever the case, it appears that it may not be backed anymore by any reserve or money laundering entity.

Whenever cryptos become “hot” as Tether has become, it can be very difficult to get those entities trusting them again. It’s highly surprising that they survived the bank run. How did they do that?

They simply lied and found ways to fulfill withdrawal requests until they couldn’t anymore. Frauds are generally like this –they have a loophole that they often have to work hard at covering up.

And when they’re caught, they simply keep spinning the wheels until more suckers get on board. It’s often a highly complicated process that most people can’t fathom. They even went as far as using money mules to fulfill specific withdrawal requests:

“As explained to [New York’s] attorneys by [Bitfinex’] counsel: Bitfinex and Tether have also used a number of other third party “payment processors” to handle client withdrawal requests, including various companies owned by Bitfinex/Tether executives, as well as other “friends” of Bitfinex – meaning, human being friends of Bitfinex employees that were willing to use their bank accounts to transfer money to Bitfinex clients who had requested withdrawals”.

Other methods included using funds belonging to Bitfinex customers to settle these withdrawals. While they were doing this, they stuck to their guns that they still had sufficient reserves to back their token. As a result, they were able to stave off bankruptcy for a while… until the New York Attorney General started investigating them.

They’ve devised other means to keep assuring the government and investors that they’re fine. They went on to claim that they had both short term securities and cash that would cover about 2/3 of all tethers in circulation. According to an affidavit submitted by the company’s lawyers,

“As of the date I am signing this affidavit, Tether has cash and cash equivalents (short term securities) on hand totaling approximately $2.1 billion, representing approximately 74 percent of the current outstanding tethers.”

Why is the Crypto Community Still Supporting Tether?

Well, a key reason is maintaining the market’s status quo. The crypto market is currently at a very delicate point.

A major hit like Tether going down is likely to dissuade investor confidence, resulting in lower prices and trade volumes –unacceptable given the present state of things. Considering that the market is just rallying, it’s easy to see why the community still supports it.

This is why some folks believe that the cryptocurrency industry is a bubble.

What’s the Current State of Things at “Tether HQ”

For starters, Reggie Fowler, a key bad actor has been arrested and is currently facing the wrath of the law. Another bad actor is still at large. Company president, Ivan Manuel Molina Lee has been extradited to Poland from Greece on charges of aiding and abetting money laundering.

Oz Yosef was recently indicted in the state of New York. All of these perpetrators were with Crypto Capital Corp. Bitfinex on the other hand, insists that they didn’t actively play any role in the scam perpetrated by CCC and its multiple shell companies.

As a result, they hope that their seized funds will be returned by the banking regulators.

The crypto community needs stablecoins. It is very unlikely to see stablecoins going away anytime soon. However, we expect stablecoins to continue growing and taking advantage of new technology.

In the long run, the stablecoin disadvantages listed above might disappear. That’s the optimistic take. Tether is by far the current bitcoin ‘black hole’ of what-if’s, many wondering how Tether plays out in 2019 and 2020.

The pessimistic take, of course, is that stablecoins could become new versions of what we originally tried to escape from: centralized banks and lending institutions.

Of course, we may not know how valuable stablecoins are until the next market crash in the crypto economy or global economy. Stay tuned to see what the future of stablecoins holds. More updates on Tether and the USDT stablecoin court cases, audits and news announcements will be added soon.

I’m Aziz, a seasoned cryptocurrency trader who’s really passionate about 2 things; #1) the awesome-revolutionary blockchain technology underlying crypto and #2) helping make bitcoin great ‘again’!

[ad_2]

Source link