US DoD Awards $40M To NORDTech Hub For Microelectronics Research

The Albany NanoTech Complex will serve as the home for the Northeast Regional Defense Technology … [+]

IBM

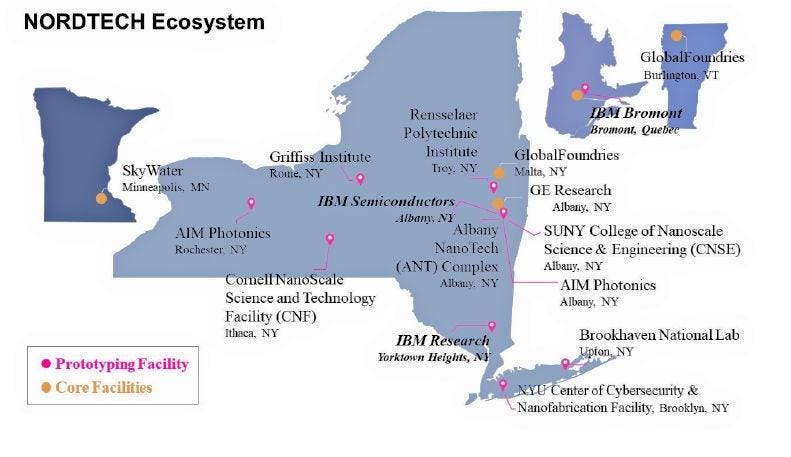

A coalition named the Northeast Regional Defense Technology Hub (NORDTech) and composed of 56 high-tech companies and educational institutions including IBM; the New York Center for Research, Economic Advancement, Engineering and Science (NYCREATES); UAlbany’s College of Nanoscale; Rensselaer Polytechnic Institute (RPI); and Cornell University has received $40 million from the U.S. CHIPS and Science Act to create one of the eight regional ME (Microelectronics) Commons Hubs in the US through the Department of Defense (DoD). The NORDTech Hub is located at the Albany NanoTech Complex, a public/private semiconductor R&D facility, and has multiple objectives including the development of advanced semiconductor processes; cultivation of a semiconductor industry talent pipeline by educating new cohorts of scientists, engineers, and technicians; and serving as an incubator for new semiconductor startups. Most of the NORDTech Hub members are located in and around New York state as shown below.

NORDTech participating companies and instutions are located primarily in New York state and the … [+]

IBM and NYCREATES

The other seven regional ME Hubs include:

- The Northeast Micreoelectronics Coalition (NEMC) Hub in Vermont

- The Commercial Leap Ahead for Wide Bandgap Semiconductors (CLAWS) Hub in North Carolina

- The Midwest Microelectronics Consortium (MMEC) Hub in Ohio

- The Silicon Crossroads Microelectronics Commons (SCMC) Hub in Indiana

- The Southwest Advanced Prototyping (SWAP) Hub in Arizona

- The California Defense Ready Electronics and Microdevices Superhub (California DREAMS) in southern California

- The California-Pacific-Northwest AI Hardware Hub (Northwest-AI Hub) in northern California

Using funds from the recently passed CHIPS and Science Act (see “American Semiconductor Innovation Coalition Readies Advanced Semiconductor Research Proposal For US CHIPS And Science Act”), the DoD plans for the eight Microelectronics Commons to serve as conduits to infuse the current US microelectronics infrastructure with money and guidance for the development of facilities and capabilities that will help semiconductor companies bolster the DoD’s efforts in developing future microelectronics innovations. Each regional ME Commons Hub will focus on key technology areas. According to a recent DoD presentation, the “Microelectronics Commons aims to enable lab-to-fab prototyping – evolve microelectronics laboratory prototyping to fabrication prototyping – in domestic facilities.”

The Albany Nanotech Complex that hosts the NORDTech Hub headquarters already supports a range of semiconductor process nodes, ranging from 65nm down to the 2nm node developed by IBM, for research and limited manufacturing. IBM announced its development of the 2nm node – which uses gate-all-around (GAA) transistor structures, the next jump beyond FinFETs – in 2021. There are plans to develop process nodes below 2nm as well. (For a detailed history of IBM’s semiconductor development work over the decades, culminating in the 2nm node, see “A Brief History of the MOS transistor, Part 4: IBM Research, Persistence, and the Technology No One Wanted.”) IBM has been working with Samsung Microelectronics and Rapidus, a Japanese semiconductor startup, to move the 2nm pilot line into production lines at those two companies’ fabs.

The DoD’s ME Hub program, part of the larger CHIPS and Science Act, is intended to boost US semiconductor competitiveness by providing an injection of capital to encourage more private semiconductor development and more public/private cooperation within the US. The US government has been instrumental in nurturing the semiconductor industry since its earliest beginnings in the early 1950s and this shot in the arm for the US semiconductor industry seems to be a once-per-generation revitalization of the industry, last observed during the DoD’s successful VHSIC (Very High Speed Integrated Circuit) Program, which spanned a decade from 1980 to 1990. Tirias Research expects that the US CHIPS and Science Act, including the announcement of the DoD’s ME Hubs, will have a similar effect and will boost the US semiconductor industry’s fortunes just as the VHSIC program did four decades ago.

The author and members of the Tirias Research staff do not actively trade stock positions in any of the companies mentioned in this article. Tirias Research tracks and consults for companies throughout the electronics ecosystem from semiconductors to systems and sensors to the cloud, including IBM. Tirias Research has consulted for AMD, Intel, Nvidia, and Qualcomm and several of the TIRIAS Research analysts have worked for semiconductor companies including Intel and AMD.

Comments are closed.